Concourse – Disputes

Automate Disputes Processing for Electronic Payment Transactions

Exception item processing, including chargebacks and adjustments, will always be part of electronic payments processing. Unfortunately, it is time-consuming and expensive. Some studies show that the average cost of processing dispute claims can be up to 15% of the total operating costs for electronic payment transactions. This is because issuers, acquirers, and third-party processors have to do the following:

- Hire and keep costly personnel who have in-depth disputes processing expertise

- Continually manage and maintain complex network regulations

- Implement procedures that ensure all workflow steps and strict deadlines are met

- Obtain quick dispute resolution so customers remain satisfied

- Process dispute claims using manually intensive systems and procedures

As the number of electronic payment transactions continue to increase, the importance of successfully and cost-effectively managing exception items is critical to a company’s financial success. Companies can no longer rely on labor intensive, manual procedures. They require an automated system that reduces operating costs and the occurrence of financial write-offs, while simultaneously creating high levels of customer service and strengthening client relationships.

The Solution

Concourse – Disputes™ is a comprehensive workflow management system that automates and manages the disputes life cycle from initial claim entry to final resolution. This includes retrieval requests, chargebacks, representments, adjustments, and other dispute-related activities.

Concourse – Disputes offers companies such as card issuers, merchant acquirers, and third-party processors an instantaneous return on investment because it allows them to do the following:

- Leverage more efficient teams that can handle higher volumes of claims because the system streamlines the disputes management process

- Eliminate the need for costly network regulation expertise because network-specific rules can be pre-configured and administered by the system

- Reduce the number of penalties and financial write-offs because the system assures all workflow steps and deadlines are met

- Obtain stronger customer loyalty because every dispute claim is processed quickly and reliably

One Solution for Issuer & Acquirer Activity

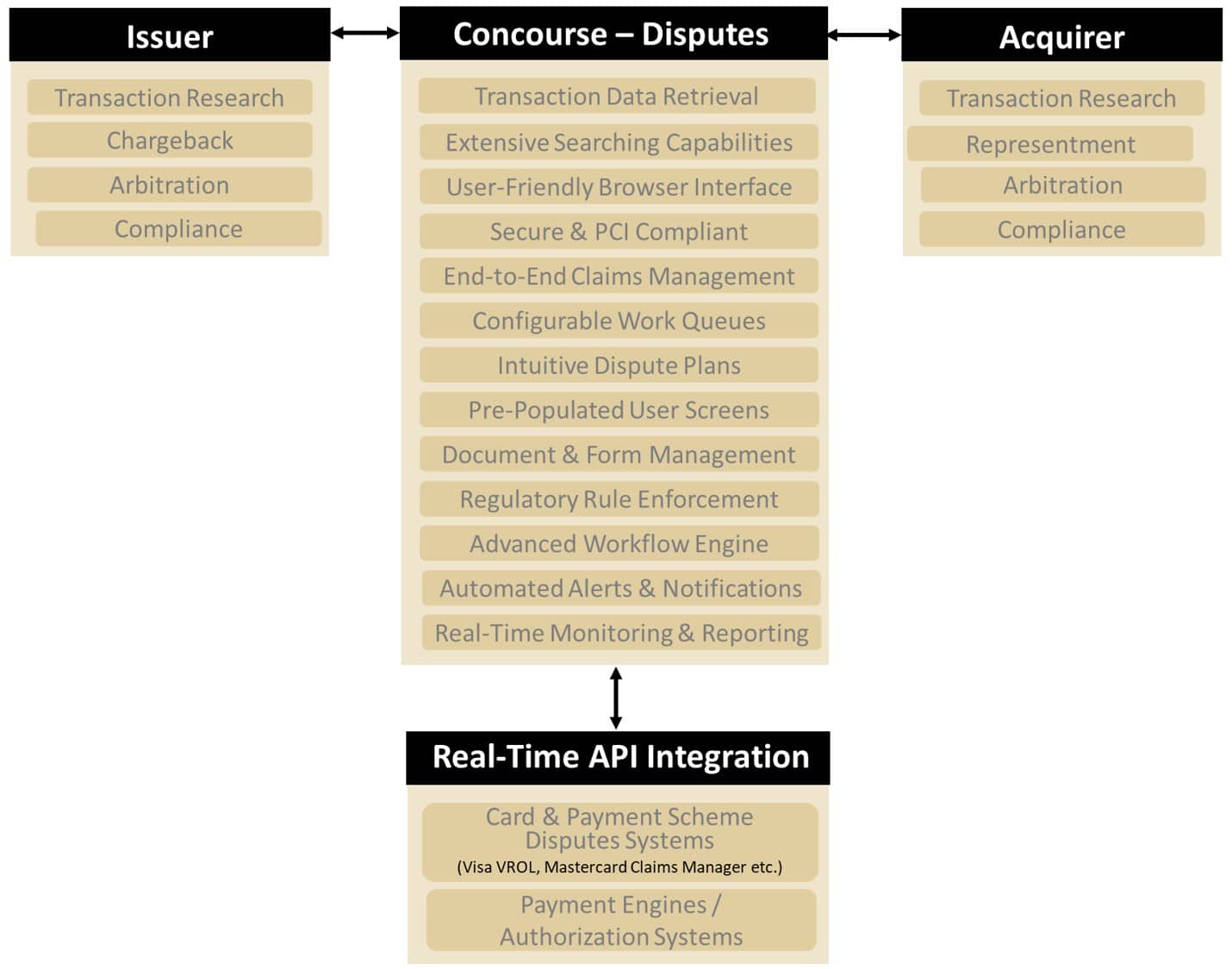

Concourse – Disputes™ handles all aspects of the disputes management process for any card or non-card payment transaction such as debit, credit, P2P, ATM, POS, and mobile. This includes international, domestic, and on-us disputes. It also supports both issuer and acquirer activity. The diagram below illustrates the life cycle of a dispute claim and the key features Concourse – Disputes provides to achieve excellence in tracking, managing, and resolving disputed transactions.

Transaction Data Retrieval

Concourse – Disputes automatically and continuously loads and stores transaction data from all transaction sources in a centralized repository. This includes data from authorization, network, and third-party sources. When transaction data from each source is loaded into the Concourse repository, the system instantly links together any data related to a single transaction (e.g., authorization, clearing item, chargebacks, etc.). Individual transaction records from a particular data source, as well as the records that have been linked from other data sources, can be easily viewed. As a result, the overall life cycle view of the transaction is available immediately and without cumbersome research.

Extensive Searching Capabilities

The system provides real-time access to all the original transaction data using a wide range of search criteria. To name a few, searches can be based on issuer, acquirer, PAN, timestamp, and terminal ID. Concourse – Disputes also provides multi-institutional support so searches can be based on multi-BIN and multi-ICA. The extensive transaction searching capabilities allows disputed transactions to be quickly researched and the best course of action to be determined.

User-Friendly Browser Interface

Concourse – Disputes provides system access via a user-friendly browser-based viewer. This allows internal users and external clients to easily research transactions, submit claims, attach documentation, and manage the dispute workflow process. Because the user interface is easy to use and provides instant access to appropriate information, it enables faster decision making and optimizes the dispute resolution process.

Secure & PCI Compliant

With Concourse – Disputes, complete data security and privacy are ensured. This includes the prevention of unauthorized access to the cardholder and other sensitive data. Both the Concourse Transaction Repository and the Concourse Viewer are compliant with Payment Card Industry (PCI) regulations because the proper security mechanisms have been put in place for data security and user access. As a result, internal users and external clients can securely access dispute features – enhancing productivity and improving customer service.

End-To-End Claims Management

Concourse – Disputes™ is a comprehensive solution that manages the entire disputes life cycle from initial entry to final resolution. This includes the management of allowed actions, dispute action dependencies, day limit and amount limit rules, approval rules for things like good faith exceptions, multi-currency for disputed amounts, supported dispute reasons, important milestones, and processing steps that ensure dispute activities are completed in a compliant manner. Since all steps are handled in one system, the disputes management process is completed quickly and reliably.

Configurable Work Distribution

Authorized users can configure how dispute claims are to be distributed among the disputes management staff. Supervisors can modify work queue assignments at any time. Work can be evenly distributed, increasing the level of productivity.

Intuitive Disputes Processing

Workflow steps are managed using an intuitive workflow configuration that guides a user to the next appropriate action. As a result, dispute analysts can successfully make progress on each dispute claim without the need for extensive disputes training and the risk of workflow errors.

Pre-Populated User Screens

Since all transaction data from all external sources is automatically retrieved, loaded, and linked together in the Concourse repository, the transaction data required to create and manage a dispute claim is already in the system and made available on the user screens. For example, when an authorized user needs to open a dispute claim, the system pre-populates the appropriate screens with the original transaction data – eliminating redundant data entry, enhancing productivity, and reducing clerical errors.

Document & Forms Management

With Concourse – Disputes, there is no longer a need for manual paper handling. Internal users and external clients have the ability to attach documentation and forms as digital images. These documents can be linked to one or more disputes or cases. Concourse – Disputes also interfaces directly with card association disputes systems such as Visa VROL and Mastercard Claims Manager. This eliminates the need to upload documents and forms into separate systems – increasing efficiency and improving turnaround times.

Regulatory Rule Enforcement

Network-specific actions, flows, rules, and regulations are configured and maintained within the Concourse – Disputes system. This is accommodated via Pre-Configured Dispute Plans. These dispute plans include reason codes, day limits, amount limits, and sequential dispute actions. Each dispute plan is configured to support the appropriate dispute actions (e.g. chargebacks, representments, arbitration, compliance) for a specific network. These dispute plans are updated by BHMI’s Concourse Product Division based on the quarterly and/or semi-annual mandate releases by networks such as Visa and Mastercard.

Advanced Workflow Engine

Concourse – Disputes also includes a workflow engine that guides the user so no steps are missed, each step is completed in the correct order, and all deadlines are met based on current dispute regulations. The system includes the business logic that ensures dispute actions are based on network-specific rules. It also allows company-specific processing steps to be injected into workflows, such as supervisory approvals.

Automated Alerts & Notifications

Concourse – Disputes automatically sends advisements and reminders via e-mail. Advisements provide notifications to appropriate users when events occur, such as a chargeback being received or an attachment being added. Reminders are generated for time-sensitive events that are at the beginning or nearing the end of their availability window. These automated notifications assure that all claims are being successfully managed and comply with time-sensitive, regulatory actions.

Real-Time Monitoring & Reporting

The online monitoring and reporting tools provide up-to-date information for all dispute activities. This includes summary and detailed information on outstanding disputes, settled disputes, future workflow steps, case activity, and analyst productivity. Concourse – Disputes provides pre-defined reports, which can be downloaded into PDF, text, CSV, or spreadsheet formats. Concourse provides all the online monitoring and reporting tools required to achieve excellence in the area of disputes management processing.

Schedule A System Overview Today

BHMI would be honored to demonstrate how Concourse – Disputes automates and simplifies the tracking, managing, and processing of exception items.