Concourse – Reconciliation

Automate Transaction Reconciliation

Any company that is processing electronic payment transactions is typically receiving data from multiple data sources. To determine financial equivalency and resolve any discrepancies between the different data sources, a reconciliation process must occur.

A Reconciliation Example

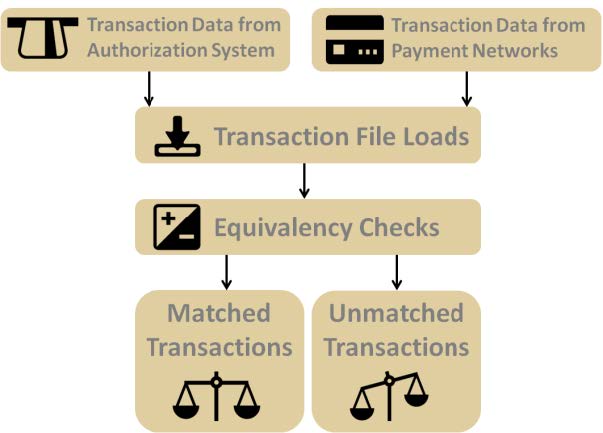

In the example below, data is being received from an authorization system and one or more payment networks (e.g., Visa, Mastercard, Discover).

Since high volumes of transaction information is often being received from many external data sources and each data source may use different business day boundaries, companies are spending a lot of time reconciling transaction data.

The Solution

Concourse – Reconciliation is a real-time, rules-based software solution that automates the reconciliation process. It allows companies to view the current reconciliation status, net positions, suspense items, and specific reasons for any data discrepancies.

Automatic Data Matching

Enhance Operational Efficiency

- Automatically load data from all transaction sources

- Perform transaction reconciliation, which matches transaction activity details between two or more data sources and provides view of transaction discrepancies

- Perform balancing reconciliation, which matches transaction amounts between two or more data sources and provides view of suspense items

Rules-Based Equivalency Checks

Reduce Financial Risk

- Define transaction activity and balance equivalency checks based on any transaction attribute

- Configure specific equivalency tolerance levels

Real-Time Reconciliation

Provide Superior Exception Management

- Review current reconciliation status

- Access suspense items and net positions

- View discrepancies the system has detected

- Quickly research and resolve each discrepancy

Transactions That Can Be Reconciled by Concourse – Reconciliation

- Credit, Debit & Prepaid

- ATM & POS

- Internet Payments

- Mobile Payments

- Other Emerging Payments

Companies that can benefit from Concourse – Reconciliation

- Regional Networks

- Payment Service Providers

- Merchant Processors

- Issuing Banks

- Acquiring Banks

Key Features & Benefits

Automatic Data Loading & Reconciliation

- Continuously load data from all your transaction sources

- Link data and create complete transaction life cycles

- Reconcile transactions from two or more data sources

- Perform transaction and balancing reconciliation

Rules-Based Reconciliation Plans

- Configure transaction and balance equivalency checks

- Define tolerance levels for equivalency checks

- Assign reconciliation plans based on transaction attributes

Real-Time Fee Reconciliation Processing

- Verify reconciliation status in real-time

- Number of transactions processed

- Previous, current, and new suspense items

- Current net position

- Data discrepancies

- Perform queries on reconciliation results

- Access wide range of online and downloadable reports

Proactive Exceptions Management

- Search for a transaction and view complete life cycle

- Access transaction details from any data source

- Easily identify the reason for discrepancy

- Quickly resolve the discrepancy

System Requirements

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.